The festive season brings out Australia’s strongest generosity, but it also attracts opportunistic scammers. The Australian Charities and Not-for-profits Commission (ACNC) has warned donors to stay “scam-savvy,” noting a sharp rise in fake charity scams. Scamwatch data shows reported losses have increased by 94% compared with the same period in 2024¹.

The festive season brings out Australia’s strongest generosity, but it also attracts opportunistic scammers. The Australian Charities and Not-for-profits Commission (ACNC) has warned donors to stay “scam-savvy,” noting a sharp rise in fake charity scams. Scamwatch data shows reported losses have increased by 94% compared with the same period in 2024¹.

If you plan to give this Christmas, a few simple checks will ensure your kindness reaches the communities who genuinely need support.

1. Your Essential Checks. Start With the ACNC Charity Register

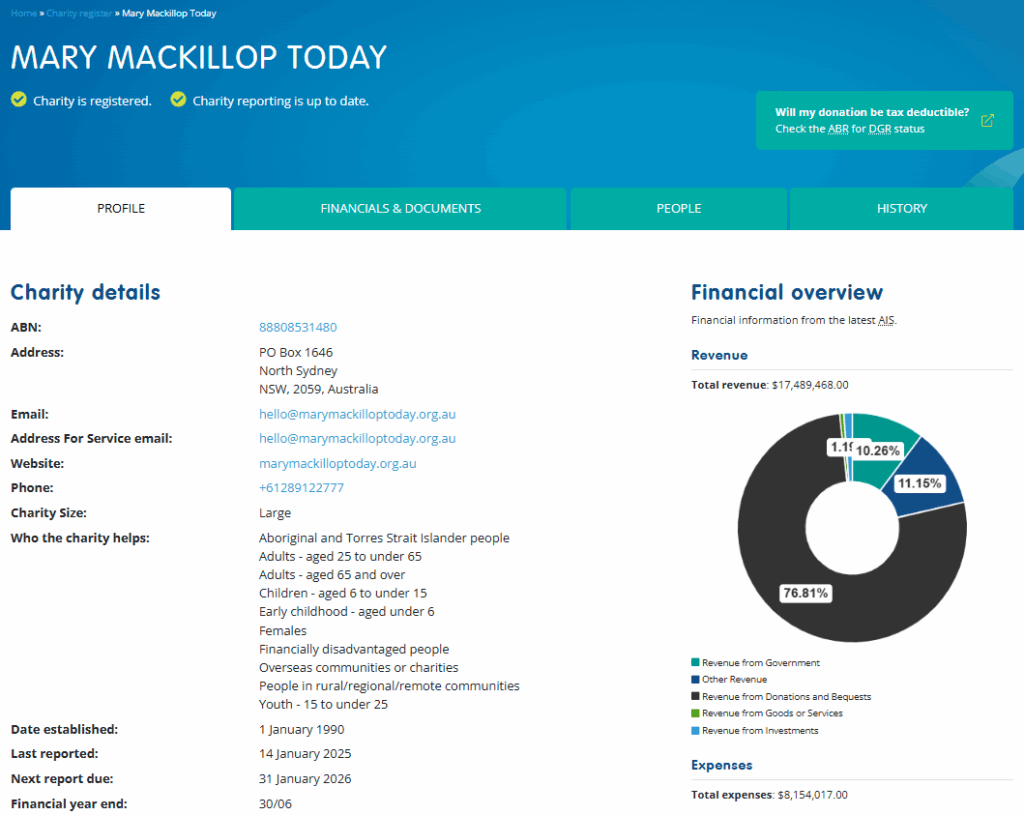

Before donating, search the ACNC Charity Register². Use the charity’s full legal name or ABN. If the charity does not appear on the Register, treat it as a major red flag.

The Register shows:

- Whether the charity is registered.

- Its programs and beneficiaries.

- Annual information statements and financials (for larger charities).

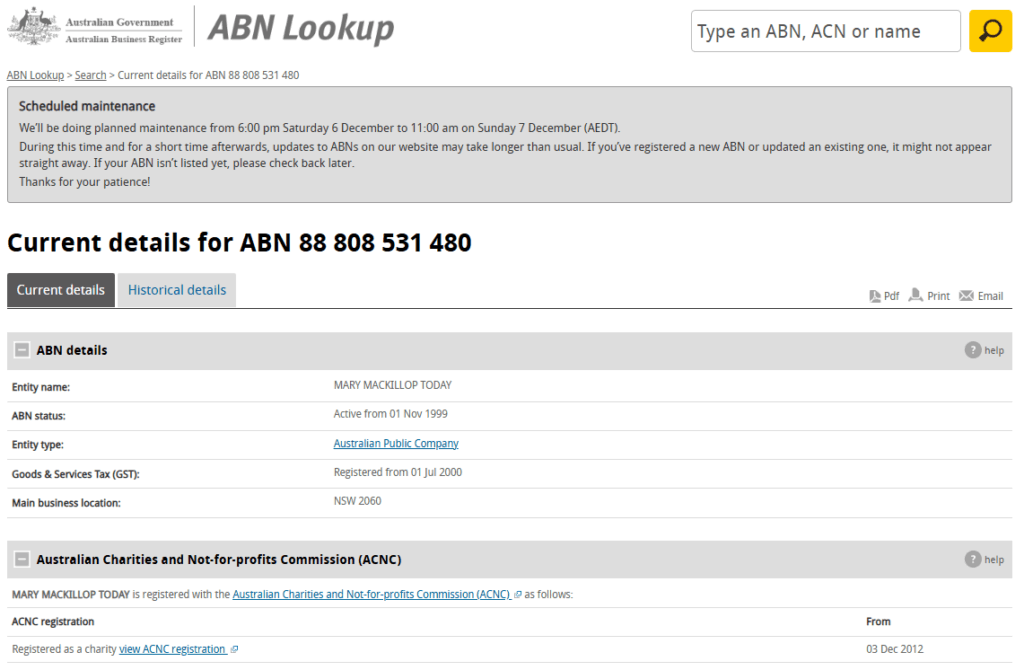

If you want to check whether a donation is tax-deductible, click through to ABN Lookup from the ACNC page. The ABN Lookup record confirms whether the charity has Deductible Gift Recipient (DGR) endorsement³.

Donations of $2 or more to a DGR can generally be claimed if you keep a receipt or written record⁴.

Example: Searching Mary MacKillop Today on the ACNC Register shows its valid registration and ABN 88 808 531 480⁵.

2. Common Scam Warning Signs

- Pressure to give without verification. Scammers often insist on immediate donations and discourage you from checking the charity’s details. Legitimate charities may use time-sensitive appeals, but they will never stop you from confirming who they are⁶.

- Requests for unusual payment methods. Fake charity scams frequently demand:

- – Prepaid gift cards (e.g. iTunes, Google Play)

- – Direct transfers to private bank accounts

- – Cryptocurrency transfers to personal wallets

These are well-known scam patterns⁷.

- Vague or inconsistent information. If the person can’t provide the charity’s legal name, ABN or website, do not donate.

- Suspicious communications. Look for:

- – Email addresses using free services (e.g. Gmail)

- – Misspelt or look-alike websites

- – Fake social pages

Always verify the details independently via the ACNC Register⁸.

- Unexpected phone calls or messages. Scamwatch warns not to give personal or banking details to unsolicited callers⁹.

3. Receipts and Tax Deductions. What You Should Expect

If you intend to claim a tax deduction:

- Donate only to DGR-endorsed organisations³.

- Keep your receipt or written confirmation. The ATO requires evidence for any claimed deduction⁴.

Legitimate charities typically provide receipts promptly, especially for online donations.

4. Online vs. Offline Giving. How to Stay Safe

Online (Generally the Safest Option)

- Type the charity’s website directly into your browser — do not click unsolicited links.

- Check for https and the padlock symbol.

- Use known payment platforms.

Scamwatch repeatedly warns against donating via links sent through text or social media messages⁶.

In Person or By Phone

- Ask for official ID and the charity’s ABN.

- Avoid handing over cash. Donate later through the official website if unsure.

- Hang up on unexpected callers and phone the charity back using a number you find independently⁹.

The Fundraising Institute Australia (FIA) also sets voluntary best-practice standards for ethical fundraising, including identification requirements for face-to-face fundraisers¹⁰.

5. Cryptocurrency Donations. Extra Caution Needed

The ACNC advises charities to carefully consider risks before accepting crypto-asset donations and to put clear governance in place¹¹. As a donor, treat requests to send cryptocurrency to a private wallet with extreme caution and verify directly with the charity.

6. If Something Feels Wrong, Report It

If you suspect a scam:

- Report it to **Scamwatch (National Anti-Scam Centre)**¹²

- Contact your bank immediately if you’ve already transferred money.

- You can also notify the ACNC if a scammer is impersonating a registered charity².

Give With Confidence This Christmas

With a few quick checks starting with the ACNC Charity Register, you can ensure your generosity truly reaches the people and communities who need it most.

Learn more about Mary MacKillop Today on our What We Do page.

Footnotes (Sources)

1. ACNC media statement referencing Scamwatch/National Anti-Scam Centre data showing a 94% rise in fake charity scam losses.

2. ACNC — Search the Charity Register guidance.

3. ACNC → ABN Lookup — checking Deductible Gift Recipient (DGR) status.

4. ATO — Claiming tax deductions for charitable donations (receipts and substantiation rules).

5. ABR / ACNC listing — Mary MacKillop Today ABN 88 808 531 480.

6. Scamwatch — Fake charity scams and urgent-pressure tactics warnings.

7. Scamwatch — Gift card scams and unusual-payment-method red flags.

8. ACNC — How to verify a charity (check website, ABN, official communications).

9. Scamwatch — Phone scams and safe response guidance.

10. Fundraising Institute Australia — Code of Fundraising Practice and identification requirements.

11. ACNC — Guidance on charities accepting crypto-assets and associated risks.

12. Scamwatch — Report a scam (National Anti-Scam Centre).