Need a Loan? With us you pay no more.

No Interest. No Fees. No Charges.

Mary MacKillop Today’s No Interest Loan Scheme (NILS) is an accredited program that was developed by Good Shepherd Sisters in 1981 and adopted by the Sisters of St Joseph and other agencies.

The loans do not attract interest and there are no fees. Borrow up to $2,000 for essentials such as appliances or furniture, to help you get your car back on the road, pay for education fees and equipment or help you cover the cost of goods and services to support your wellbeing. Borrow up to $3,000 for housing related expenses such as bond or rent in advance, or for recovery from a natural disaster.

Repayments are set up at an affordable amount up to 24 months.

How does NILS work?

NILS isn’t a payday loan and it’s not a bank loan. NILS works through a process called ‘circular community credit’. This means when a borrower makes a repayment to NILS, the funds are then available to someone else in the community. NILS loans are available through Mary MacKillop Today, supported by Good Shepherd Microfinance.

Watch the video to find out more!

Who can apply?

- Earn less than $70,000 annual income (before tax) as a single person or $100,000 annual income (before tax) if you have a partner or children; OR

- Have experienced family or domestic violence in the last 10 years; OR

- Have a Health Care Card / Pension Card; AND

- You can show you can afford to repay the loan

You will require documentation to verify the above. Please contact us if you’re unsure if you qualify.

What we loan for

Borrow up to $2000 for essential goods and services including:

- Household items like appliances, whitegoods & furniture

- Car repairs & registration

- Medical, dental, wellbeing and life event expenses

- Technology like a phone or laptop

- Education expenses like fees or uniforms

- Employment expenses like licenses or equipment

Borrow up to $3,000 for:

- Bond & rent in advance

- Rates

- Costs associated with a natural disaster

How to apply

1. Enquiry

Contact us on : (02) 6331 2010

or email us at:

[email protected] or

go to our website:

loansmarymackilloptoday.org.au

2. Application

Once all documents are received, we will meet with you face to face or in a phone interview to discuss your financial situation and we will help you apply.

3. Assessment

Your loan application and supporting documentation will be assessed against our criteria.

4. Approval

You will be notified if your loan has been approved and the funds are paid directly to the supplier.

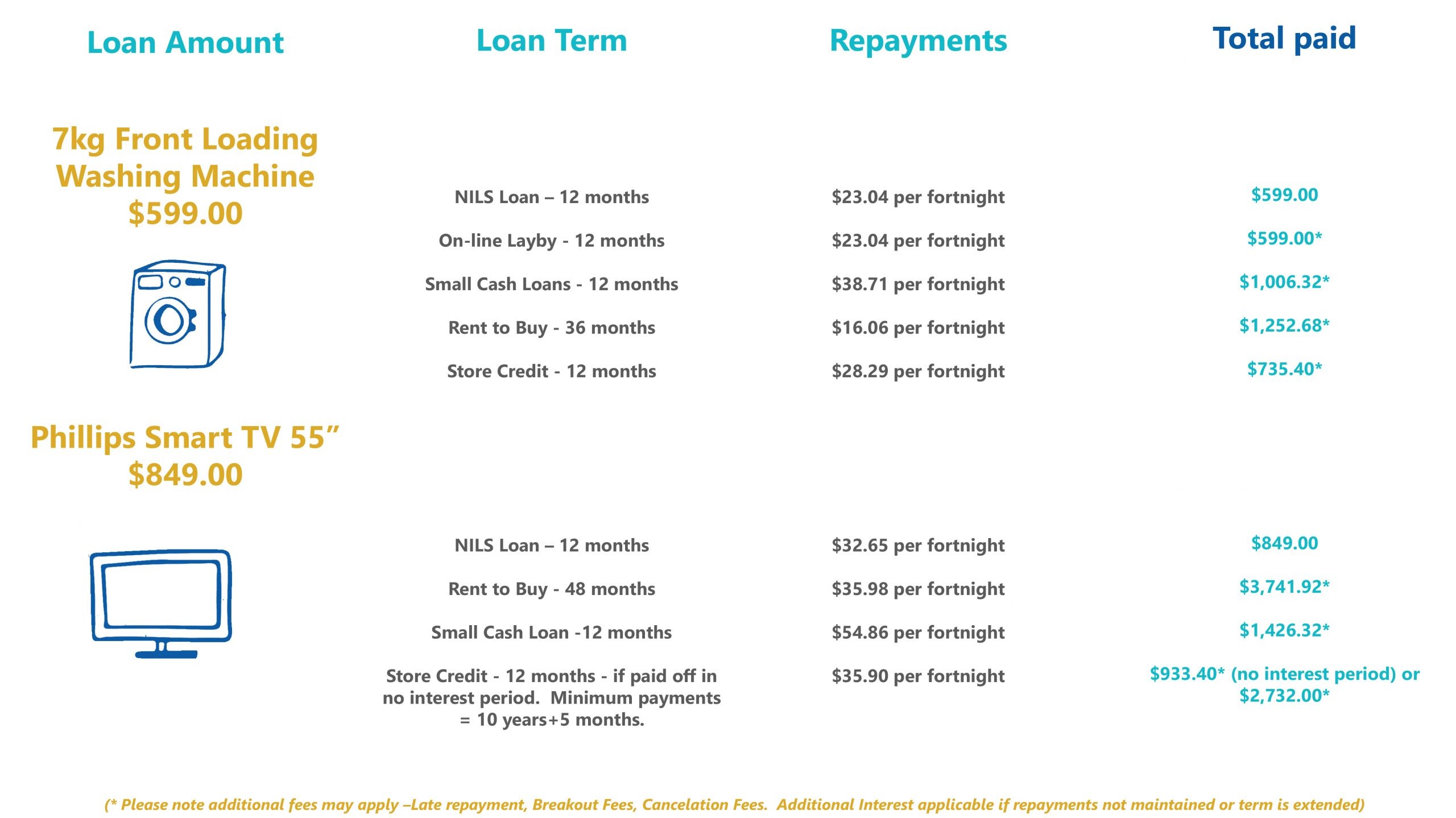

Below is a table showing an example comparison between NILS and other loan providers. This is only a guide, please speak to our Financial Inclusion Officers if you have any questions – click the table to enlarge.

(Figures are correct as of August 2018 and taken from advertised Rent to Buy and Pay Lenders websites and calculated with Money Smart Calculators).

NILS for Vehicles

NILS for Vehicles is a fee free, interest free loan of $2000 to $5000 that can be paid off over up to 48 months with simple fortnightly repayments. NILS for Vehicles is a variation our existing NILS program.

NILS for Vehicles is for the purchase of a vehicle that is used for transport. This includes cars, motorcycles, mobility scooters and boats. Please note this does not include recreational bikes, boats or caravans. The vehicle being purchased must be road worthy (excluding mobility scooters).

Vehicles can be purchased from a dealer or through a private sale. All money is transferred directly to the person or business selling the vehicle. We do not lend cash.

Contact us for more details.

We’re here to help

Mary MacKillop Today’s Financial Inclusion Program does more than NILS, we can help you with a number of services, including;

• NILS for Vehicles

• Work and Development Orders (WDO)

• Energy Accounts Payment Assistance (EAPA)

• Budgeting

• Referrals to appropriate services

If you’d like to apply call: (02) 6331 2010 between 9am-2pm or email: [email protected] or click on the below button to go to our website www.loansmarymackilloptoday.org.au

We have offices in Bathurst, Orange, Cowra, Lithgow, Young, Condobolin, Mudgee, Kandos, Blue Mountains and Penrith Region however our services are not restricted to these areas so call our friendly team today!

Mary MacKillop Today’s NILS program is an initiative of the Sisters and is delivered in partnership with Good Shepherd Microfinance.